選擇權Long gamma策略 就是雙BUY

對選擇權Long gamma策略而言,原本Delta中立的選擇權部位,當行情大幅下跌時,由於正gamma的關係,部位會自動變成負Delta,此時投資人可以利用買進買權的方式,一方面部位Delta調整成中立,另一方面等於將獲利拿來加碼部位的gamma值。

老外的研究 蠻下功夫的 (未完...)

Gamma trader

• With Delta neutrality, not directional trade

• Long Gamma.

• Rebalance Delta after price move.

• Make money regardless either way the market goes

• Assumption: price will move sharply in either way.

• Risk: price stays put, but time flies. Lose time value

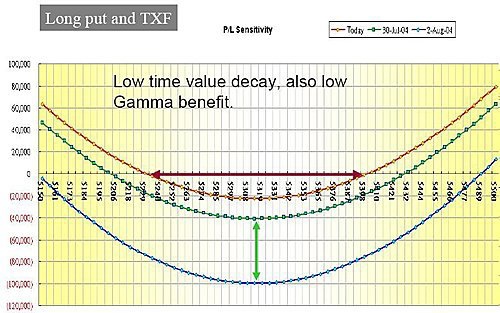

Gamma trade implementation

• Long option and use futures to neutralize Delta.

Long call and short TXF, or long put and long TXF

• Long call and put to neutralize Delta.

• Case study:

– July 29 TXF =5318 , expiration 8/19, IMV = 29%

• Alternative one:

+112 5300 put, +13 TXF

• Alternative two:

+100 5300 call +115 5300 put

Two more thoughts

• If IMV changes,

– IMV up, Vega can make up some losses.

– IMV down, Vega will make loss worse.

• If Gamma is higher.

– Around the money and near expiration.

– Easier to benefit from Gamma

– Much worse in time decay.

– Implication: ?

The tradeoff between Vega and Gamma

• Gamma and Vega are both highest at the money.

• On second thought:

– Gamma is getting higher when approaching expiration

around the money.

– While, Vega is diminishing when approaching expiration.

– So, even though it is very likely to benefit from Vega and

Gamma, the question is which one is more?

– If this is a

留言列表

留言列表